Advanced Insurance Analytics for Business Leaders

Intellicus can simplify analytics for insurance companies with an advanced BI platform that unifies enterprise data and enables self-serve analytics for enhanced customer experiences. Read this product sheet to know how we do that.

Connect Multiple Sources for Centralized Data Access

Insurance companies collect data from multiple sources – legacy data stores, ERPs, CRMs, RDBMS, flat files, big data lakes and warehouses, cloud data warehouses, etc. Intellicus helps extract information from disparate sources and creates consolidated data models via pre-aggregation and collation across datasets. A single version of truth prevails for users throughout the organization.

Stay Vigilant and Stop Insurance Fraud

Intellicus combines AI and ML capabilities to identify fraudulent claims early on. The platform provides accurate suspicion scores across locations (states, cities, districts, etc.) and divisions (property, vehicle, health, professional, etc.). It determines normal levels in the data sets and identifies abnormal occurrences or groups with the highest number of fraud claims filed over a period.

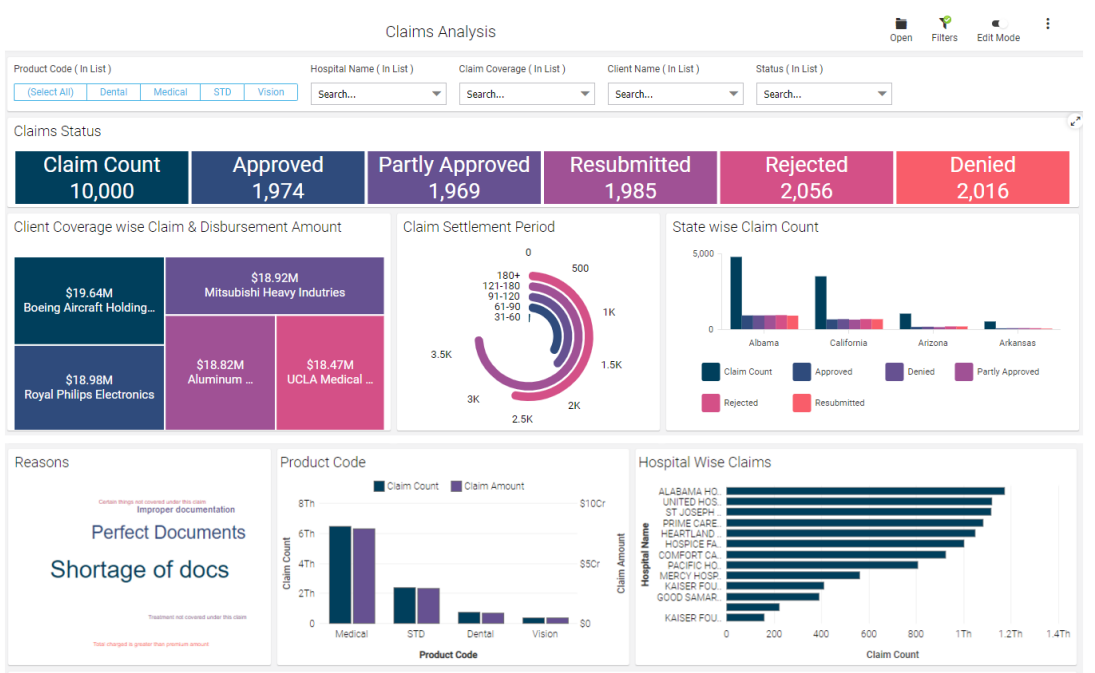

Claims Management as Simple as 1-2-3

Insurers can’t afford to drop the ball when customers expect fair and prompt claims management. Intellicus BI brings more efficiency to the process with CRM integration. Now, claim adjusters can access customer profiles and siphon essential information, including prior claims to deliver personalized experiences.

Never Miss an Opportunity to Grow

Intellicus BI enables comprehensive data visualization to draw actionable insights instantly. Users will get a 360-degree view of new market trends and can strategize to tap more opportunities. Whether monitoring the performance of partnering agencies or looking at product holdings and claims data, rich customer insights help spot new and profitable sales prospects.

Enable Sales Teams with Holistic Insights

Custom-tailored experiences give insurers a competitive edge in the market. Intellicus allows sales teams to get detailed and real-time visualizations for every product or agency. This helps determine the most profitable channels and identify the weak spots that need corrective actions.

Operational Efficiency for Improved Underwriting

Intellicus helps insurers take the guesswork out of their underwriting processes with powerful and interactive visualizations. They can identify bottlenecks and streamline the process at every stage. Companies can harness up-selling and cross-selling opportunities by estimating the quote requests received for a product or the number of policies sold over a period.