Debt Collection with Predictive Analysis

Debt Collection Use Case

Debt collections is one of the most complex portfolios in the BFSI and BPO industries. It needs multiple KPI iterations to recover lost revenue and each iteration impacts recovery margin. Intellicus’ debt collection analytics enable financial institutions to optimize debt collection processes strategically.nalyse, listen and rate even a single call right from Intellicus dashboards.

Armed with business intelligence and analytics, debt collection teams can implement data driven strategies to curb debts and enhance overall portfolio performance.

Business Challenge

Financial institutions seek ways to optimize their debt collections operations. However, they often lack visibility into their data and gauging the real impact of a derailed debt collection process is a constant challenge.

The Intellicus Solution

Intellicus provides a single source of truth for a 360° assessment of the business. Intellicus’ dashboards enable debt collection teams to perform portfolio and risk assessments for evaluating risks vs opportunities. Machine learning based analytics help the teams predict probable outcomes and hone their strategies to maximize recoveries and minimize spends.

Intellicus also provides deeper insights into agent performance along with the capability to analyze, listen and rate every customer interaction directly from Intellicus dashboards.

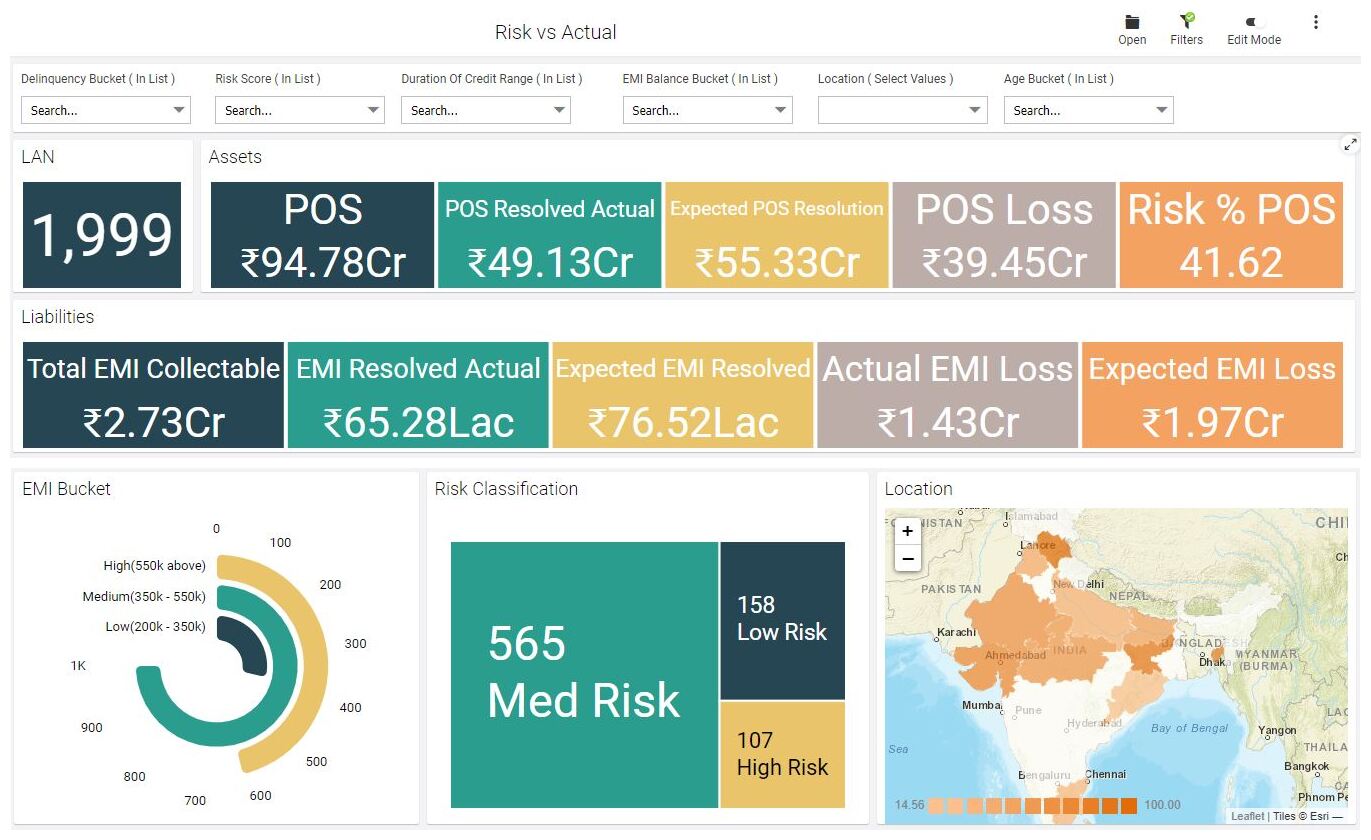

Portfolio Insights & Risk Analysis Dashboard

This dashboard gives a comprehensive overview of the current state of the debt portfolio. Its key components include:

Age Bucket which categorizes customers by age and helps debt collection teams to strategize their collection approach and tailor customer outreach.

EMI Category which reflects the customer segmentation based on the outstanding principal of the customer. This metric helps the recovery team understand risk categorization and strategize to improve recovery spend per unit.

Employment Split segregates customers on the basis of employment status. Collection teams can prepare nuanced strategies such as timing recovery attempts for salaried customers close to salary payment days, while considering payment patterns, type of business and other demographics may yield more effective strategies for self-employed customers.

The dashboard is designed to help business draw insights on portfolio performance based on predictions for expected recovery from the portfolio in terms of principal outstanding sum (POS) resolution, expected collectible EMI, expected EMI loss and expected POS loss. The portfolio data can be filtered by KPIs like:

- Duration of Credit is a critical KPI to measure the customer tenure with the product for debt collection portfolio. The KPI helps to prioritize accounts on the basis of loan tenure and to reduce non-performing asset (NPA) impact.

- Risk Score helps segregate the customer into risk categories as low, medium or high risk based on their propensity to pay. The risk score KPI helps personalize the strategy for each customer and refine the approach based on factors like location, delinquency, payment history or EMI category. More such factors or attributes can be included to refine customer risk scores, thus improving the recovery spend per unit.

Once the risk score is identified, Intellicus can help business predict collections. The dashboard provides a comparison of the predicted collections versus the actuals across multiple KPIs. This allows debt collection teams to assess the effectiveness of the recovery strategy and the overall performance of the portfolio.

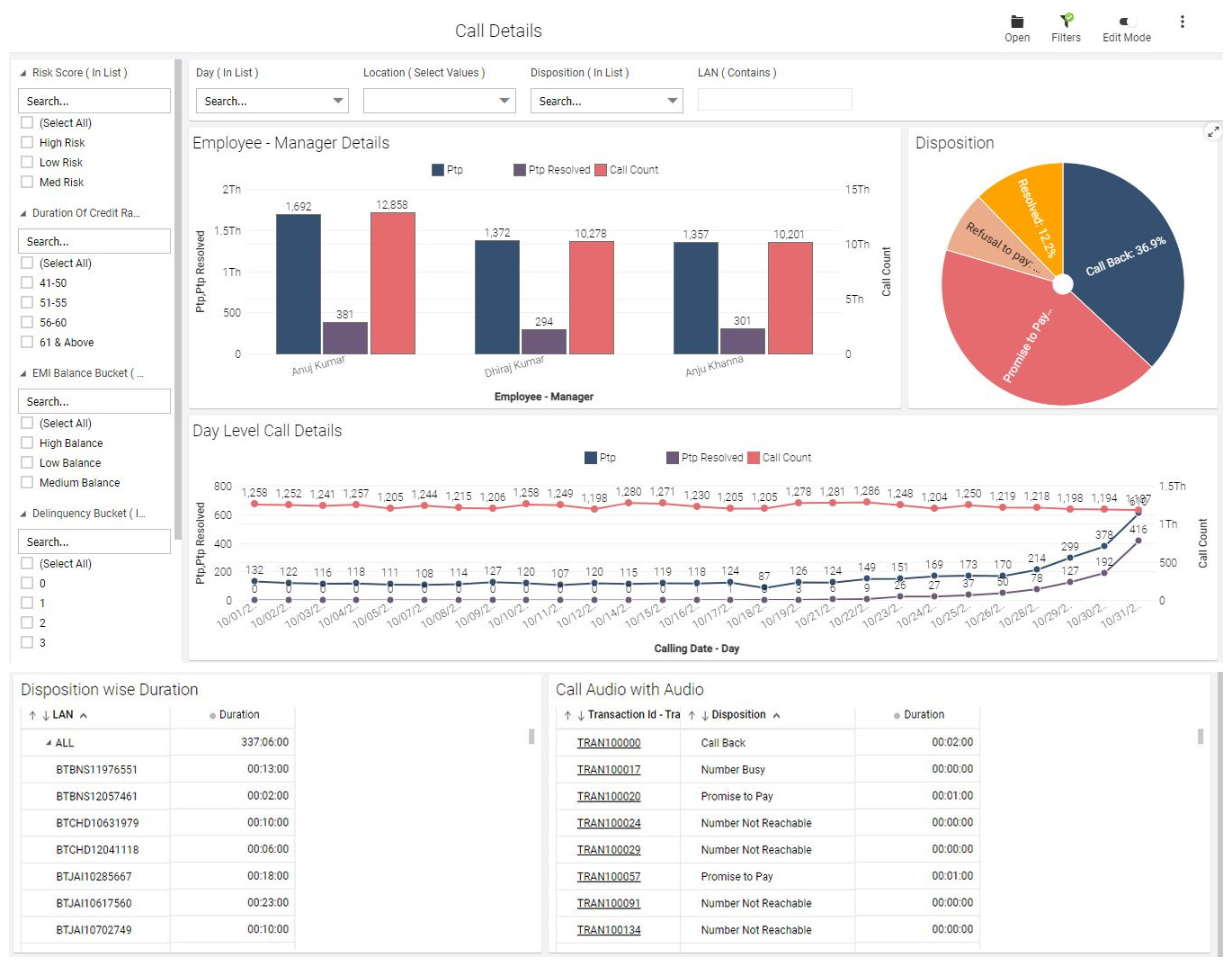

Call Details Analysis

Intellicus dashboards also provide an in-depth analysis of customer interactions based on risk score, duration of credit and other metrics. It provides in-depth information from number of calls made to their duration, disposition and quality and details the complete flow of actions on a given account number in a single click. This single view delivers insights on the number of attempts, the disposition and customer response etc. and provides immediate access to call recordings to QA and training teams for agent evaluation and feedback.

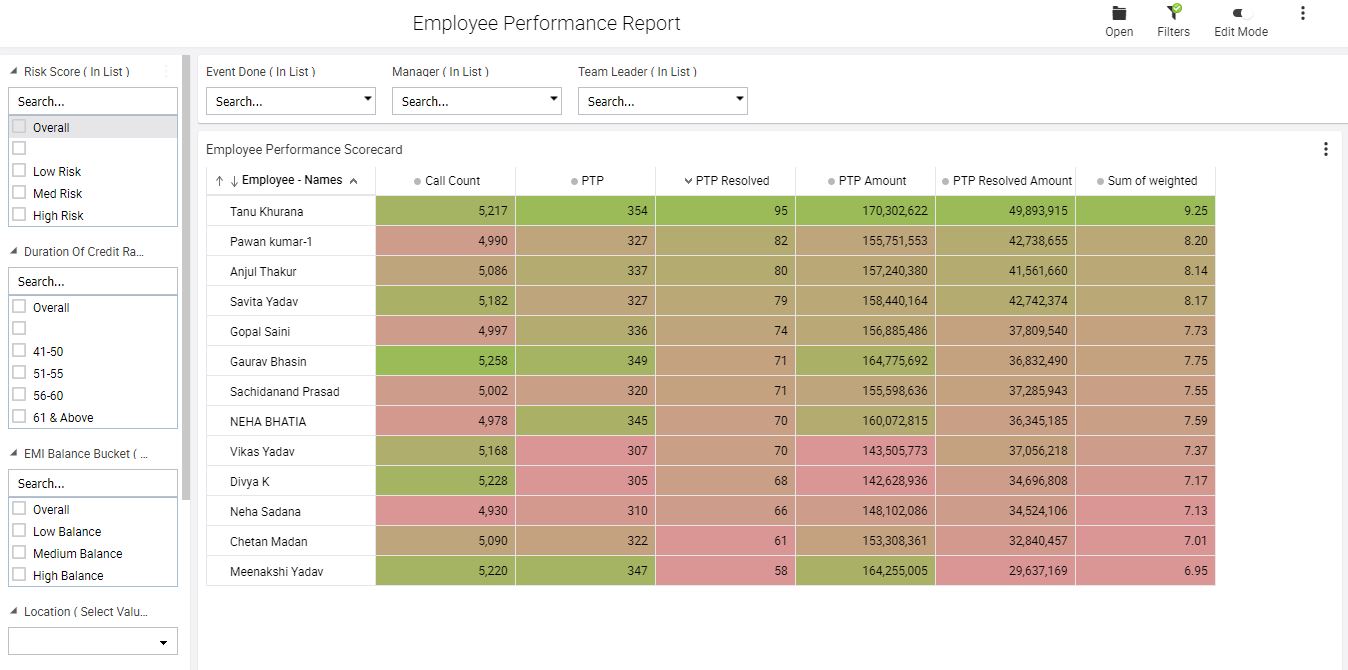

Employee Performance Analysis

Intellicus also brings modern visualization like heat map analysis of employee performance vs their peers, helping managers in identifying the right resource for the task and evaluating their team’s performance, opportunity areas and outliers on the go.