Improve Debt Collection with Predictive Analytics & Machine Learning

Debt collection is one of the most complex portfolios that need multiple KPI iterations to recover lost revenue. Each iteration impacts decision time and the revenue margin. Speed and right decision making is of the essence here. With machine learning driven analytics organizations can gauge the profitability, turnaround time, and performance of a portfolio, even before they take it up.

Intellicus BPO analytics solution for debt collection has enabled businesses to formulate highly effective strategies to curb debts, predict collection, and enhance overall portfolio performance. Businesses can reduce costs significantly while increasing revenues and optimizing efficiency. You can identify which accounts are likely to have a higher probability of paying, plan operations accordingly, and get maximum collections output in a short time span.

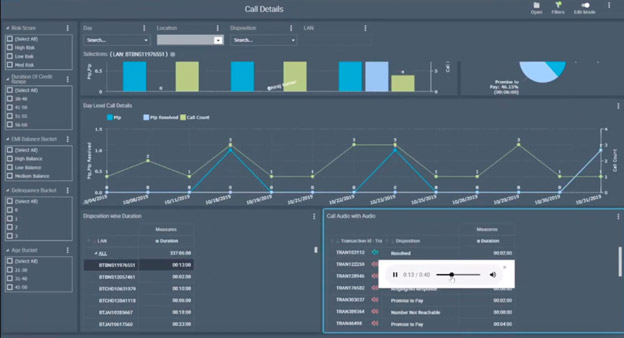

In a single dashboard get a complete glimpse of where your portfolio stands today. View loan accounts, risk assessment, strategy approach, decision-making, contact validation for each customer, and more in one go. You can view the aggregate stats and then drill down to deeper details of any segment.

With debt collection analysis, you can drive business impacted KPIs for your customers, basis factors like age, principal outstanding amount, employment status, duration of credit, credit history, payment track record, and more. These KPIs help drive risk scorecards which enable businesses to define custom strategies for different customers to pay and improve collection efficiency. The risk score for each customer will get changed in real time on basis of customer behavior and the tool will suggest next level recommendations based on past or recent outcomes.

Through risk scorecard and machine learning prediction businesses can predict what accounts are likely to pay sooner than others and can plan operations accordingly. Users can compare the predicted values, versus the actual collections made for a given duration. This recurring cycle leads to gradual improvements in portfolio conversion with every step. These insights are helpful to further improvise collections.

Additionally, the same dashboards can be leveraged to monitor the quality and performance of the team. All customer actions are updated in real-time and are accessible for leadership review. On a single screen, Quality teams can view the complete life cycle followed for an account, listen to the call recordings right from the dashboard, and input their suggestions for the agent in real-time.

Intellicus debt collections use case automates all processes associated with the collections life cycle, from data management to last level customer interactions. It fosters a proactive and aggressive approach to debt collection, ensuring maximum operational effectiveness.